When Life Gives You Lemons … Part I

February 10, 2025

When Life Gives You Lemons … Part II

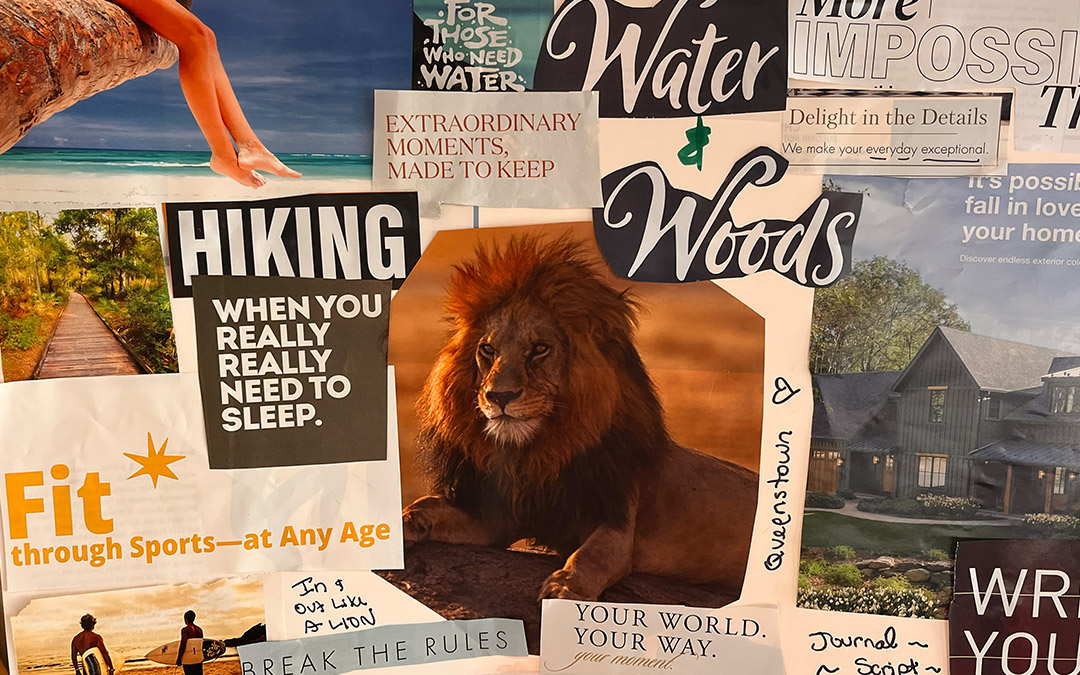

February 13, 2025Have you ever felt like your financial goals are just out of reach? Or maybe you know what you want but struggle to stay motivated to make it happen? The key to turning your dreams into reality starts with visualization—and a vision board is the perfect tool to help you do just that.

A vision board is more than just a collage of images; it’s a powerful tool that helps you stay focused on your goals and take intentional steps toward financial success. By creating a visual representation of your dreams—whether that’s buying a home, building wealth, retiring early, or traveling the world—you train your mind to work toward making them happen.

You can create a vision board that not only inspires but also empowers you to take control of your finances and flourish in financial confidence.

Why a Vision Board Works

The science behind vision boards is simple: when we see our goals regularly, our brain starts working subconsciously to achieve them. This practice, known as mental rehearsal, helps us stay motivated and take action toward our goals. Here’s why it’s effective:

- Clarity: It forces you to define what financial success looks like for you.

- Focus: Keeps your priorities front and center.

- Motivation: Serves as a daily reminder to make choices aligned with your goals.

- Accountability: Helps you track progress and make adjustments when necessary.

Step 1: Define Your Goals

Before gathering supplies, take a moment to reflect on your financial aspirations. What do you want to achieve in the next year? Five years? Ten years? Write down goals that inspire and challenge you, such as:

- Build an emergency fund (3-6 months of expenses)

- Become debt-free

- Increase your income (salary raise, side hustle, investing)

- Buy your dream home

- Retire comfortably

- Fund your child’s education

- Travel without financial stress

Your vision board should reflect these goals so that each time you look at it, you’re reminded of why you’re making smart financial choices.

Step 2: Gather Your Supplies

Creating a vision board doesn’t require much, but you’ll want to have the following items:

- A poster board, corkboard, or digital platform (like Canva or Pinterest)

- Magazines, printed images, or stickers

- Scissors and glue (for physical boards)

- Markers, pens, or paint for customization

- Inspirational quotes or affirmations

Step 3: Find Visual Representations of Your Goals

Now, it’s time to bring your vision to life! Look for images that represent financial empowerment and success. Here are some ideas:

- A house (if homeownership is a goal)

- A plane or passport (for travel dreams)

- Stacks of cash, investment charts, or a savings account screenshot

- A healthy meal or gym photo (for overall well-being and financial health)

- Words like “Debt-Free,” “Wealth,” “Financial Freedom”

- A happy family or friends (for work-life balance and personal happiness)

Place them strategically on your board so they tell a story of your future success.

Step 4: Add Financial Affirmations

Words have power, and incorporating affirmations into your vision board can reinforce a positive mindset. Here are some powerful money affirmations:

- “I am in control of my finances.”

- “I attract wealth and abundance.”

- “My money works for me.”

- “I am worthy of financial success.”

- “I make smart and intentional financial decisions.”

These affirmations will help you rewire your mindset around money and encourage confidence in your financial journey.

Step 5: Place Your Vision Board Where You’ll See It

For your vision board to be effective, you need to see it daily. Hang it in your office, bedroom, or any place where it will be a constant reminder of your financial goals. If you create a digital version, set it as your phone or computer wallpaper.

Step 6: Take Action and Adjust as Needed

A vision board is just the first step. To turn dreams into reality, you need a plan and action steps:

- If your goal is to save for a house, open a dedicated savings account and automate deposits.

- If you want to invest more, schedule a meeting with a financial advisor.

- If paying off debt is a priority, create a realistic repayment plan.

As your goals evolve, revisit your vision board and adjust it to reflect new aspirations.

Your Vision Board is Your Financial Blueprint

Creating a vision board isn’t just about pretty pictures—it’s about setting intentions, taking control, and believing in your ability to achieve financial success. Every time you look at it, remind yourself: You are capable. You are in control. You are on the path to financial freedom.

Now, take the first step. Create your vision board and start making your financial dreams a reality today!